Commuting Time vs. Taxes: The Ultimate Comparison of Over 300 Municipalities Around Zurich

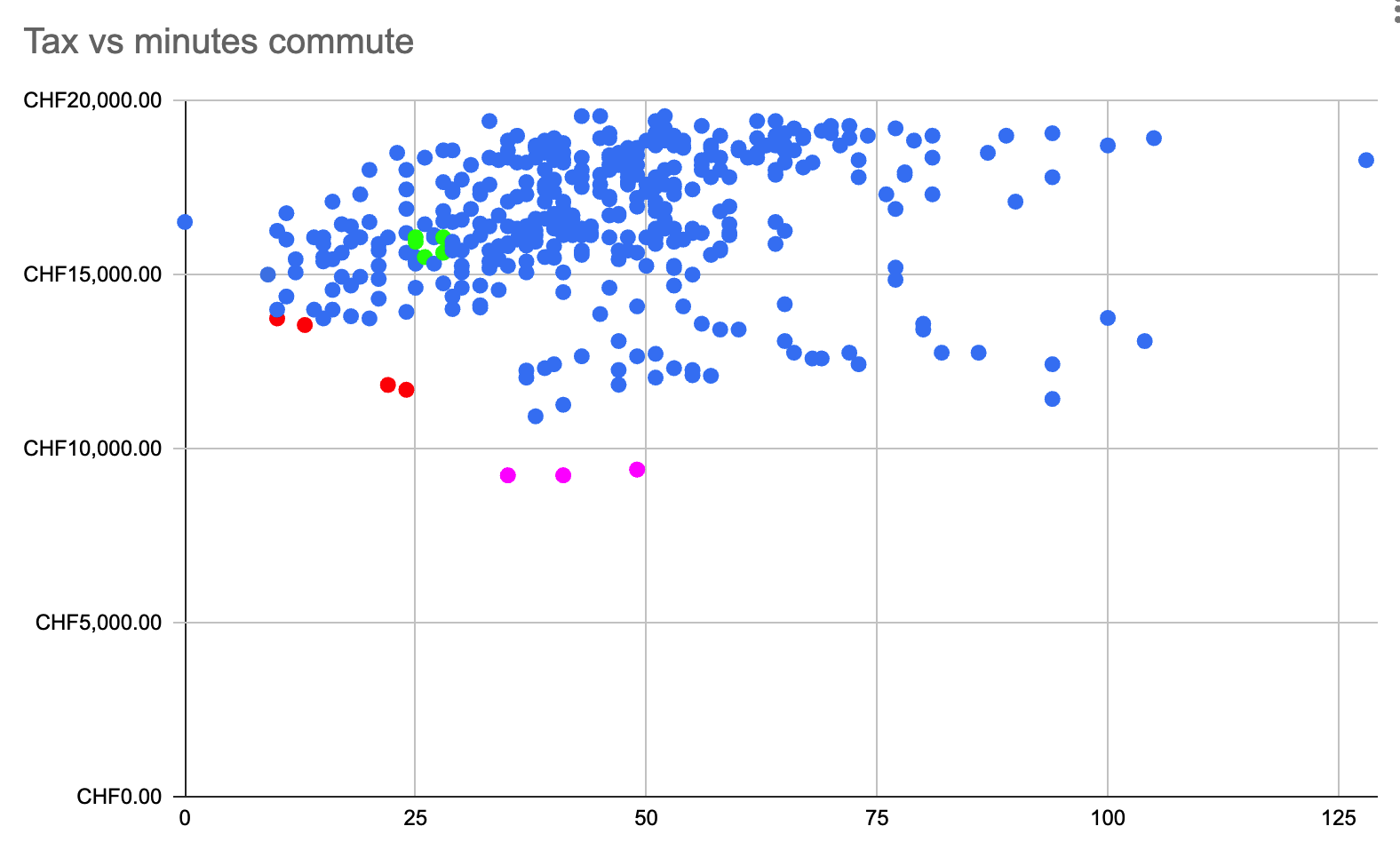

Choosing the ideal place to live in the Zurich region presents many with a classic dilemma: Should you accept higher taxes for short commute times, or longer commutes for tax savings?

To answer this question, we analyzed over 300 municipalities around Zurich, comparing both commute times and tax rates. The result: The differences are more significant than many think

Methodology: How We Calculated

Our analysis is based on the following assumptions:

- Household type: Single household without children

- Annual income: 100,000 CHF (taxable)

- Taxes: Complete tax burden (federal, cantonal, municipal)

- Commute time: Calculated using public transport from the town center to Zurich Main Station

Important note: Actual taxes may vary depending on individual circumstances. For precise calculations, use the official federal tax calculator.

The detailed data from our analysis can be found in this Google Sheets table.

Key Findings

Our data analysis reveals interesting patterns:

The Majority of Municipalities: 25-60 Minutes Commute Time

Most municipalities studied have commute times between 25 and 60 minutes. Within this timeframe, tax rates typically range between 13% and 19%.

Tax Savings: Up to 6,000 CHF Annually Possible

A comparison shows: Moving to a municipality with lower taxes can save 6,000 CHF per year or around 500 CHF monthly.

The 35-Minute Effect

Those willing to commute over 35 minutes unlock particularly attractive tax savings. The reason: From this distance, you can reach municipalities in cantons like Aargau, Zug, or Schwyz, which generally have lower tax rates.

But beware: Municipalities with very low taxes often have higher rental prices – an important factor in total cost consideration.

Chart: Y-axis shows annual taxes in CHF, X-axis shows commute time in minutes from the municipality to Zurich Main Station. Data source: Google Sheet

The Sweet Spot: 30 Minutes, 16% Taxes

Our analysis shows: The optimal balance lies at about 30 minutes commute time and a tax rate of around 16%. Here you'll find the best ratio between tax burden and commute.

Extremes in Comparison: 10,318 CHF Difference!

The range of tax rates in the region is impressive:

🔴 Highest Tax Burden

Tägerig: 43 minutes commute time, 19.57% tax rate

→ 19,568 CHF annual taxes

🟢 Lowest Tax Burden

Freienbach: 35 minutes commute time, 9.25% tax rate

→ 9,250 CHF annual taxes

Conclusion: Between these extremes lies an incredible 10,318 CHF difference per year!

Our Top Recommendations by Category

Based on our analysis, we've categorized the best municipalities into three groups:

🔴 Premium Zone: Short Commutes, Moderate Taxes

Ideal for those who want to minimize commute time

| Municipality | Commute Time | Tax Rate | Annual Taxes |

|---|---|---|---|

| Küsnacht (ZH) | 10 min. | 13.76% | 13,757 CHF |

| Kilchberg (ZH) | 13 min. | 13.57% | 13,568 CHF |

| Zug | 22 min. | 11.84% | 11,847 CHF |

| Baar | 24 min. | 11.71% | 11,708 CHF |

💰 Savings Zone: Maximum Tax Optimization

For those willing to accept longer commutes for maximum savings

| Municipality | Commute Time | Tax Rate | Annual Taxes |

|---|---|---|---|

| Freienbach | 35 min. | 9.25% | 9,250 CHF |

| Wollerau | 41 min. | 9.25% | 9,250 CHF |

| Feusisberg | 49 min. | 9.42% | 9,416 CHF |

🟢 Balance Zone: Best Value for Money

The golden middle ground between commute time and taxes

| Municipality | Commute Time | Tax Rate | Annual Taxes |

|---|---|---|---|

| Otelfingen | 25 min. | 16.09% | 16,086 CHF |

| Weiningen (ZH) | 26 min. | 15.52% | 15,520 CHF |

| Steinmaur | 27 min. | 16.09% | 16,086 CHF |

| Oetwil an der Limmat | 28 min. | 15.65% | 15,645 CHF |

Conclusion: Finding the Perfect Balance

When choosing the perfect place to live, many other factors naturally play a role, such as proximity to friends and family, urban or rural environment, and local recreational opportunities. Our comparison of commute time and taxes, however, provides an important financial perspective. It can help you make an informed decision – for example, whether you'd rather spend a bit more on rent and save on taxes instead.

Especially in the Zurich region, another crucial factor is housing availability. To make your search easier, immogecko.ch is the optimal platform. Here you'll not only find available apartments, but can also view them directly filtered by their accessibility via public transport from your workplace. This way, you can quickly and efficiently find your new home that perfectly matches your needs.